Well, the cat seems to be out of the bag after the last Federal Reserve (Fed) meeting took place just a few short weeks ago. Fed Chairman Powell hinted at their next move, and it appears to be what many have been long anticipating – a rate cut. There was no official mention of how much, how many, or exactly when this cut would be coming. Nevertheless, many assume, including myself, that the Fed will look to cut at their FOMC meeting next week. While the Federal Reserve operates across 12 districts, its primary goal remains consistent: to maintain market stability.

While most anticipate a 25-basis point reduction, some are advocating for a more aggressive 50 basis point cut.

Speed Kills

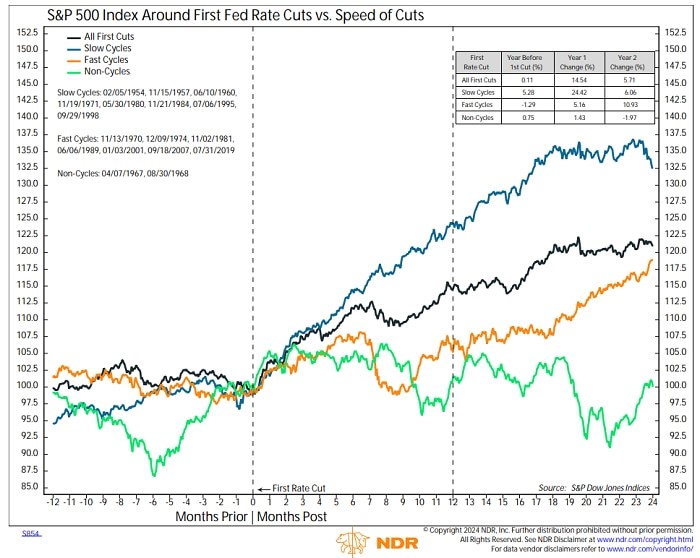

If we divide the Fed cutting cycles and comparatively take a closer look at the speed at which the Fed trims rates, it is clear there is a surefire winner in terms of return of the overall S&P 500. This covers the prior year leading into the initial rate cut of each cycle along with the second and third years following the first cut made. When the Fed’s cutting cycles were cut considerably slower, equities performed by a landslide much better than when their decision was to cut more rapidly.

Source: ©Copyright 2024 Ned Davis Research, Inc.

1954-8/30/2024. The chart and table shows S&P 500 Index performance around the start of Fed easing cycles. Y-axis is indexed to 100 at start of first rate cut. An index number is a figure reflecting price or quantity compared with a base value. The base value always has an index number of 100. The index number is then expressed as 100 times the ratio to the base value. A fast cycle (orange line) is one in which the Fed cuts rates at least five times a year. A slow cycle (blue line) has less than five cuts within a year while a non-cycle (green line) is case with just one cut. Black line represents all first cuts. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

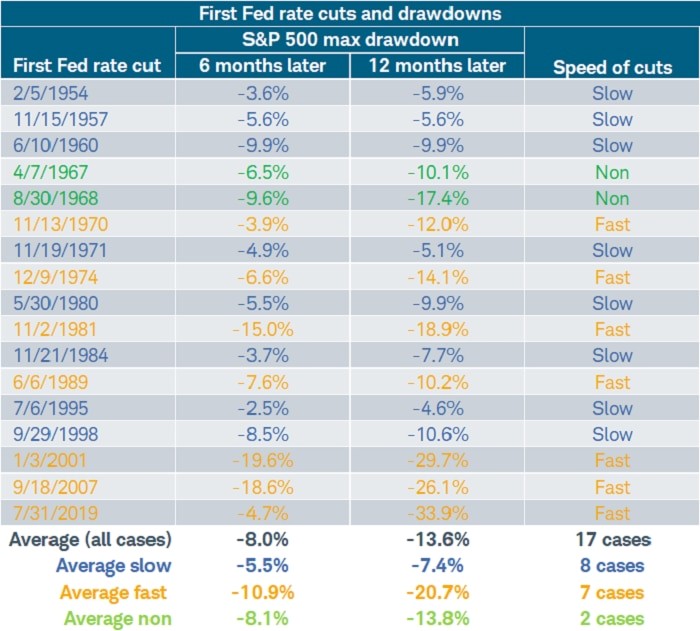

Now, if we look specifically at maximum drawdowns for the S&P 500 depending on the type of cutting cycle the Fed undergoes, we see a very similar story. When the Fed cuts rates more quickly, the S&P’s maximum drawdown is nearly double that of when the Fed considers cutting at a slower rate. Altogether, the average drawdown after any cut is about -8% after any type of cut at all. Compounded with the next six months following that, the S&P on average returns an even worse return of -13.6%. It is important to note that the S&P Index regularly adjusts its holdings, and over the years (especially as of now), it has a very extreme lean toward tech and communication companies rather than the value and industrial companies of much earlier years. With that being said, tech in turn is often much more sensitive to rates than value and industrial sectors.

Source: Charles Schwab, Bloomberg, Federal Reserve, Ned Davis Research Inc., as of 8/30/2024.

A fast cycle is one in which the Fed cuts rates at least five times a year. A slow cycle has less than five cuts within a year while a non-cycle is case with just one cut. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

So where does the big money go?

Well, this answer obviously is not so simple, but there are a few areas that historically seem to trend better in times of cutting. Sector leadership surprisingly has another element other than just the speed of the rate cutting itself. Leadership trends with treasury yields. Utilities and consumer staples are normally known for their dividend-oriented aspects; however, they are also notably overlooked for their inverse relationship with long-term treasury yields. However, sectors like healthcare and real estate tend to perform much more steadily when long-term treasury yields fall.

It needs to be said that, regardless of the relationships sectors have with yields, no one knows what could come moving forward.

The Skinny

The Fed has been clear in its intention to begin cutting rates at this month’s FOMC meeting. Rate cuts tend to be more effective and have a quicker impact when they occur outside of a recession. Gradual rate cuts have historically been more beneficial for equities than rapid ones.

There is a common saying that the Fed often takes the escalator up (when raising rates) and the elevator down (when cutting rates). However, this cycle was reversed during the Fed’s recent hiking campaign. Equity investors should hope the Fed adopts a more gradual approach when cutting rates.

Disclaimer: The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

Investing involves risk including loss of principal. No strategy assures success or protects against loss.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful

Notable Sources: https://www.schwab.com/learn/story/its-time-fed-pivot