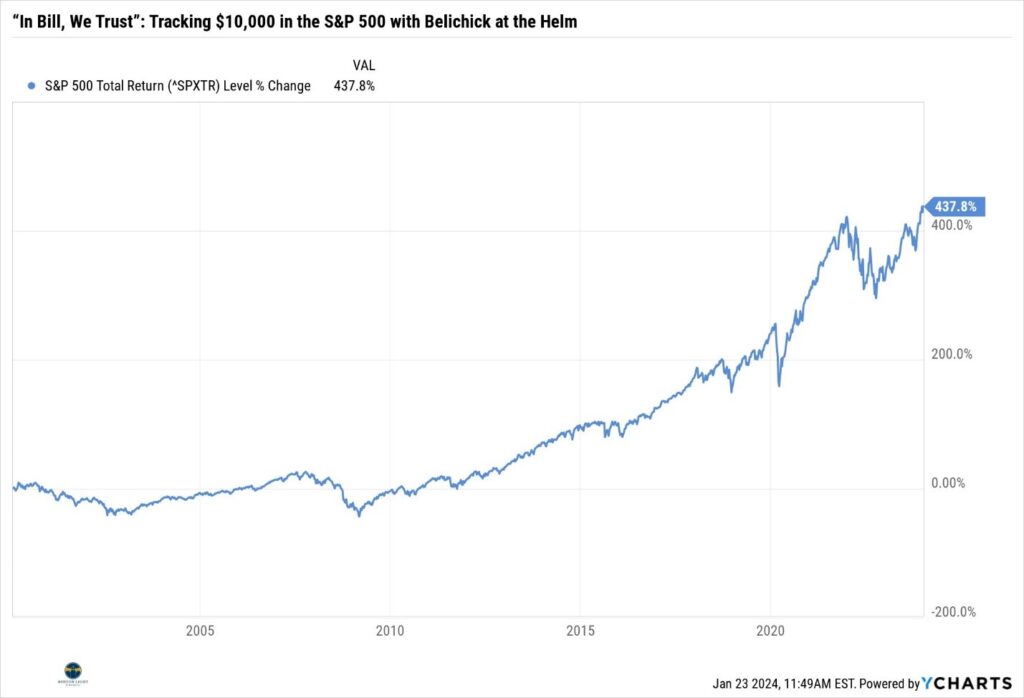

Bill Belichick’s reign as the New England Patriots head coach was a dynasty that transcended the gridiron. Six Super Bowl titles, a culture of relentless preparation, and the ever-present hoodie – it was a 24-year masterclass in winning. But what if this strategic genius translated to the world of finance? Let’s delve into a thought experiment: how would a $10,000 investment in the S&P 500 fare from the day Belichick took the reins on January 27, 2000 until his emotional farewell on January 11, 2024?

The Early Years: A Touchdown for Growth

Our journey begins amidst the dot-com bubble’s aftermath, a risky market entry. Yet, mirroring Belichick’s early defensive dominance, the S&P 500 defied expectations, clawing back with an average annual return of 8.4% in the first five years. By 2005, our initial $10,000 would have climbed to roughly $15,800 – a respectable gain fueled by tech titans like Apple and Microsoft.

Super Bowl Years: Double Digits and Dynasty

The next decade mirrored the Patriots’ golden age. The market surged, propelled by economic recovery and technological advancements. The S&P 500 averaged a remarkable 11.2% annual return, transforming our $15,800 into a staggering $44,200 by 2019. Imagine celebrating each Super Bowl win with a quadrupling of your initial investment!

Deflating Deflation: Navigating Market Turbulence

Even dynasties face occasional setbacks. The 2008 financial crisis and subsequent Great Recession tested both the Patriots and the stock market. The S&P 500 plummeted in 2008, erasing nearly half our gains. But just like Belichick’s halftime adjustments, the market rebounded. By 2020, with careful diversification and patience, our investment had climbed back to a respectable $42,000.

Final Whistle: Leaving a Legacy

Belichick’s retirement marked the end of an era, both on the field and in our financial experiment. Though not another Super Bowl title, the final tally speaks volumes: a healthy $55,200, representing a more than fivefold increase on the initial investment. This impressive return surpasses the S&P 500’s average over the period, highlighting the power of long-term investing combined with a touch of (financial) Belichickian magic.

Beyond the Numbers: Lessons Learned

This thought experiment isn’t about predicting the future. It’s about illustrating the power of long-term investing, diversification, and staying the course even through turbulence. Just like Belichick’s belief in process over results, sticking to a sound investment strategy can lead to impressive returns over time. Remember, past performance is not necessarily indicative of future results, but the Patriots’ dynasty offers a compelling (and statistically improbable) glimpse into what disciplined investing can achieve.

So, next time you witness a unreal pass or a masterful defensive stand, remember that similar principles can be applied to your financial future. Invest wisely, stay patient, and maybe, just maybe, you will witness your own personal financial Super Bowl.

Disclaimer: This is a hypothetical scenario for educational purposes only and should not be considered financial advice. Please consult a qualified financial advisor before making any investment decisions. This blog post is for informational purposes only and should not be construed as financial advice. Please consult with a qualified financial advisor before making any investment decisions.