The S&P 500, a benchmark for the US stock market, is set to high new all-time high today (February 7th , 2024) , sending a wave of excitement and trepidation through investors. While the headlines scream “bull market confirmed,” the question remains: what does history tell us about what happens next?

Short-Term Performance: A Cautiously Optimistic Outlook

While the past isn’t a crystal ball, historical data offers some valuable insights. Studies show that after reaching a new high, the S&P 500 has often continued its upward trajectory. One year later, the average return sits around 15.3% [1]. This positive trend strengthens over two years, with an average gain of 23% [2].

However, it’s important to remember that volatility is a constant companion of the stock market. Even after reaching a peak, short-term fluctuations and corrections are still a possibility. Investors should be prepared for potential dips and avoid making panicked decisions based on short-term movements.

Long-Term Perspective: Riding the Bull Market Wave

Reaching a new high often signifies the continuation of a bull market, a period of sustained price increases. Since 1957, bull markets have lasted an average of nearly five years, generating an average return of over 169% for the S&P 500 [3]. This long-term perspective can be encouraging for investors with a long-term investment horizon.

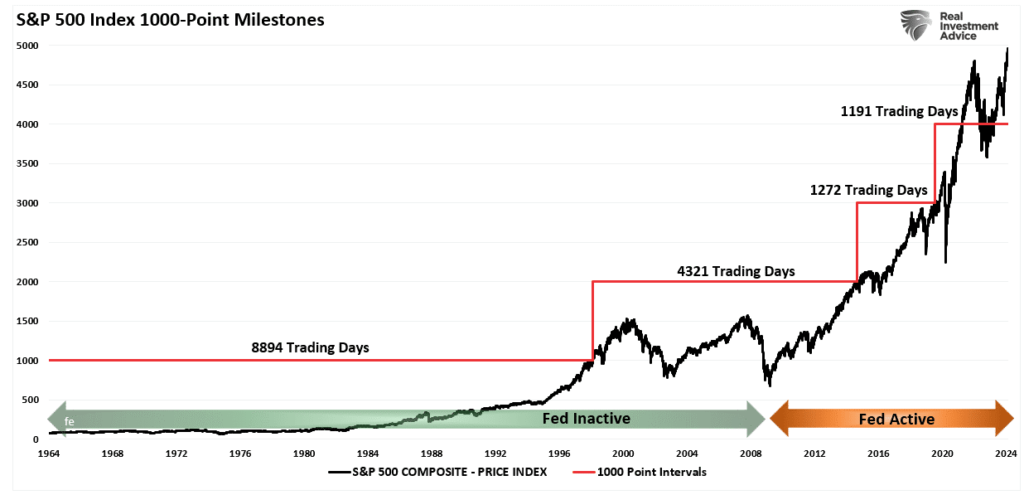

Figure 1: S&P 500 Index 1000 Point Milestones. Chart was created by Real Investment Advice. Please see Source [4] for more details.

But a word of caution: Past performance is not a guarantee of future results. External factors like economic developments, interest rate changes, and geopolitical events can significantly impact the market, potentially derailing even the most promising bull runs.

Beyond the Headlines: Nuances and Individual Stocks

It’s important to remember that the S&P 500 represents a broad basket of 500 large US companies. While the index’s performance offers valuable insights, individual stocks within the index may behave differently. Diversification across sectors and asset classes remains crucial for managing risk and mitigating potential losses.

Furthermore, the context surrounding a new high matters. If it follows a bear market (a significant decline), the subsequent gains could be stronger than after a period of steady growth. Understanding the market environment and individual company fundamentals is crucial for informed investment decisions.

Investor Psychology: Riding the Emotional Rollercoaster

News of a new high can trigger a surge in investor confidence, leading to increased buying and potentially further price appreciation. However, excessive optimism can be dangerous. It’s important to remain grounded, remember that markets are cyclical, and avoid making investment decisions based solely on emotional reactions.

The Bottom Line: Consult Before You Invest

While historical data offers some insights, it’s crucial to remember that it’s not a guarantee of future performance. Before making any investment decisions, consult with a financial advisor. They can help you understand your risk tolerance, assess your individual circumstances, and build a personalized investment strategy aligned with your long-term goals.

Disclaimer: All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. This is a hypothetical scenario for educational purposes only and should not be considered financial advice. Please consult a qualified financial advisor before making any investment decisions. This blog post is for informational purposes only and should not be construed as financial advice. Please consult with a qualified financial advisor before making any investment decisions.

Sources:

- Nasdaq: https://www.nasdaq.com/articles/the-sp-500-just-hit-an-all-time-high:-the-best-way-to-invest-right-now

- Forbes: https://www.forbes.com/sites/wesmoss/2024/01/31/what-an-sp-500-all-time-high-could-mean-for-your-investments/

- Charles Schwab: https://www.schwab.com/learn/story/back-black-sp-500-hits-all-time-high

- Investing.com: https://www.investing.com/analysis/sp-500-set-to-hit-5000-milestone-but-history-warns-of-a-looming-correction-200645819